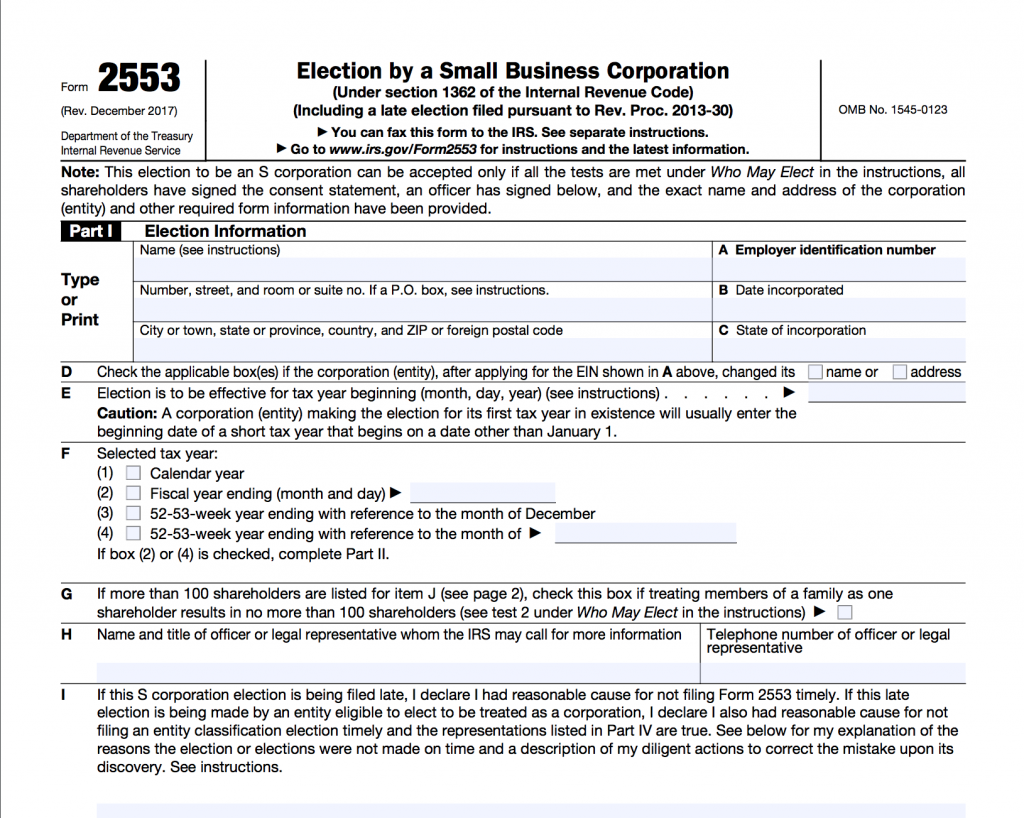

S-Corp Election: How to file form 2553 online with the IRS?

You need to file Form 2553, Election by a Small Business Corporation to be treated as an S corporation by the IRS. You may file the form online, but only from the ElectSCorp website. If you would prefer to file it offline, these instructions may be helpful.

Name and Address

Enter the corporation’s legal name and full address. If the business address is also an individual’s, follow the corporation’s name with “C/O” plus that person’s name. If the name or address is different from the EIN application, check the box in Item D.

Section A

Enter the corporation’s EIN (Employer Identification Number). If you don’t have one, you must apply for one. If you’ve applied but haven’t gotten it yet, write “Applied For” in this box with the application date.

Section B & C

Enter the date and state you incorporated the business you now want S corporation status for.

Section E

If you are electing to be an S corporation for your very first tax year, this date will probably not be January 1. Instead, it should be the earliest of when your corporation first:

- Had owners

- Had assets

- Started doing business

Note that Form 2553 usually must be filed no later than 2 months and 15 days after the date you enter here. Exceptions are found in When To Make the Election:

- If this isn’t the first tax year of your existing company, and you want to keep your current tax year, indicate the start date of the first tax year that you want your S corporation status to take effect.

- If this is not the first tax year of your existing company, but you want to change your tax year, there will be a “short tax year” between your original and new tax status. If you want to be an S corporation during the short tax year, enter the start date of that year.

- If you don’t want to be considered as an S corporation during the short tax year, enter the start date of the tax year that follows this short tax year. But note that you will also have to file Form 1128, Application to Adopt, Change or Retain a Tax Year.

Section F

Check the box that applies to the tax year you chose above. If you check box 2 or 4, which are not calendar years, you will have to specify the dates you’ve chosen and complete Part II of this form.

Section G

S corporations can’t have more than 100 shareholders. If there are more than 100 listed in column J, members of the same family may be treated as one shareholder. If you want to do this, then check the box in Section G.

Section H

Provide the name, title, and phone number of one of your S corporation’s officers or the name and number of its legal representative so the IRS knows who to call with questions.

I

If you are filing this form later than you were supposed to, explain why you had reasonable cause to do so and what actions you took once you discovered the mistake.

Signature

A corporate officer who is authorized to file this form must sign and date it. Otherwise, it will not be considered as filed on time.

Column J

List the names and addresses of all shareholders, current or former, who are required to consent to S corporation election.

Column K. Shareholder’s Consent Statement

Shareholders can consent by signing and dating in column K or use a separate consent statement. When more than one person has an interest, such as community property, joint tenancy, etc., all parties must consent. Minors or their legal representative may sign for a minor’s consent, as can their parents (natural or adoptive) if there is no other legal representative.

Estate executors or administrators and ESBT trustees, as well as owners of grantor and QSST trusts, may consent. A continuation sheet or separate consent statement may be used. It must contain all of the information requested in columns J through N, as well as the name, address, and EIN of the corporation, and must be attached to Form 2553.

Column L

List the number of shares each shareholder owned on the date(s) they were acquired and the date the election is filed. An LLC or other entity without stock must enter the percentage of ownership and date(s) acquired. Enter -0- for all former shareholders listed in column J.

Column M

Enter the Social Security number of individuals and the EIN of estates, trusts, or exempt organizations in column J.

Column N

Enter the date each shareholder’s tax year ends or the tax year the shareholder is changing to. Attach an explanation, including the present tax year and basis for the change.

Part II

— Box P1

If your corporation qualifies for automatic approval (Section 7 here), you can request a natural business year (Section 5.07 of Rev. Proc. 2006-46) or an ownership tax year test (Section 5.08 of Rev. Proc. 2006-46). Note that if you don’t have a 47-month period of gross receipts, you can’t choose the natural year. If you prefer to use a fiscal tax year, you must choose between Items Q and R.

— Box Q1

Attach a statement with your reasons to establish a business purpose for the requested fiscal year. If based on one of the natural business year tests, provide the required receipts.

There is a $6,200 user fee if you check box Q1, but you don’t have to pay it when filing this form. The corporation will be notified when it’s due.

— Box Q2

If you are qualified to make a 444 election (See Form 8716, Election To Have a Tax Year Other Than a Required Tax Year), you can choose it as a backup in case your business purpose request isn’t approved.

— Box Q3

You agree to use a calendar tax year if your business purpose request is not approved and it turns out you aren’t qualified for a 444 election.

— Box R

This is where you actually make the 444 election, in which case, you must also file Form 8716: Election To Have a Tax Year Other Than a Required Tax Year, either by attaching it to Form 2553 or filing it separately.

Part III

If any of your shareholders are listed as a qualified subchapter S trust (QSST), this form must be filled out and the owners must sign for consent in column K.

Part IV

These are the requirements you must meet to file your S corporation election late, and they must be attached. See Relief for a Late S Corporation Election Filed By an Entity Eligible To Elect To Be Treated as a Corporation.

S corporation election can be a complicated process, so it is advisable that corporations enlist the guidance of professionals to complete Form 2553 and its attachments. If you need help filing your Form 2553, please contact us. We will be more than happy to assist you in any way we can.